INSURANCE

Trust The Evidence.

Close Claims Faster.

MeaConnexus and MeaFuse equip insurers with evidentially robust tools to authenticate claimant media, conduct secure remote interviews, and eliminate the growing risk of deepfakes, manipulated submissions, and digital fraud. Together, they help insurers accelerate claims decisions, reduce operational cost, and protect underwriting integrity.

CHALLENGES

Challenges Faced by Insurance Organisations

Rising digital fraud driven by manipulated photos, videos, synthetic audio, and AI-generated claimant identities.

Inconsistent evidence submission, with claimants sending screenshots, altered images, or unverifiable media from email or messaging apps.

Operational delays due to travel for interviews, manual transcription, interpreter needs, and scattered data collection.

High pressure to improve customer experience while reducing overall claims lifecycle time.

Fragmented digital evidence workflows across adjusters, investigators, claim handlers, and SIU teams.

Growing requirement for provable authenticity for regulatory compliance, litigation readiness, and fraud mitigation.

THE SOLUTION

How MeaConnexus & MeaFuse Address These Challenges

Instant Proof of Authenticity for Submitted Evidence

MeaFuse seals all claimant submitted media: photos, videos, recorded statements, documents and social media evidence. It does this by using blockchain hashing and metadata capture, ensuring provenance and immutability.

Real-Time Deepfake & Identity Fraud Protection

MeaConnexus provides real-time deepfake detection and active liveness checks during remote interviews, ensuring the claimant, witness, or service provider is genuine. This significantly reduces the rising risk of synthetic identity claims and staged fraud.

Evidential Claims & Fraud Interviews

Conduct secure, tamper-evident interviews with policyholders, witnesses, medical providers, or repair agents without needing on-site attendance.

Automatic transcription, real-time translation, silent observers for SIU or legal teams, and host-controlled access and permissions.

Faster Claims Resolution, Reduced Costs

MeaConnexus eliminates: adjuster travel, physical inspections when digital evidence is sufficient, manual transcription, and interpreter fees.

These factors deliver significant per-case savings and accelerate claims cycle time.

Stronger Fraud Prevention & Policyholder Verification

With blockchain backed video records, insurers can confidently challenge:

Altered evidence, staged incidents, manipulated online content and disputed interviews.

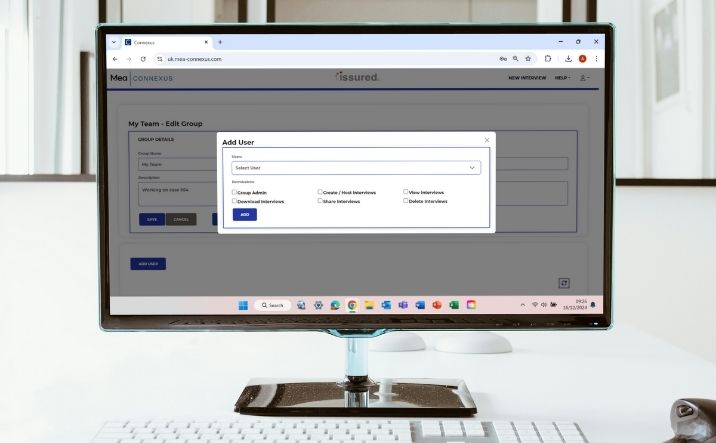

Secure Collaboration Across Claims, Underwriting & SIU

Teams can create secure groups for individual cases, high-risk claims, or fraud investigations. This ensures strict control over who can view, download, or manage evidential files.

Audit Trail & Disclosure-Ready Evidence

Each interview or submission generates a complete evidential package with:

Video/audio, transcripts, chat logs, and Blockchain validation documents.

This supports litigation, arbitration, and regulatory reporting.

Digital Chain of Custody

Easily manage and retrieve digital evidence, with a clear, defensible audit trail for every interview and file.

MeaConnexus – Secure Remote Interviewing for Claims & SIU

– Blockchain secured interview recordings

– Real-time deepfake detection

– Automatic transcription & real-time translation

– Silent observers for SIU teams

– Host-controlled permissions & conditional access

– Secure chat and attachment sharing

– Connect Now rapid launch for urgent incidents

– No downloads & works on any device

– Downloadable evidential packages for disclosure

– Faster claims validation and customer decisioning

– Lower fraud exposure through identity and integrity verification

– Reduced operational travel, admin cost and cycle time

– Stronger compliance for disputed claims, litigation and regulatory audits

MeaFuse – Authenticated Digital Evidence Capture for Insurance

– Tamper-evident capture of media from any device

– Digital chain of custody using patented blockchain cryptography

– Seals web pages and social media content (e.g. staged accident posts, claimant activity)

– Automatic metadata capture

– Browser based evidence management

– Instant sharing to secure investigative teams

– Can operate on any device, anytime, anywhere

– Available on iOS, Android, MacOS and Windows

– Immediate verification of claimant provided evidence

– Eliminates reliance on unverifiable screenshots or forwarded media

– Reduces need for expensive forensic analysis

– Improves SIU efficiency and speeds up fraud case triage

”"Zurich have worked in close partnership with Issured to integrate MeaConnexus into our existing counter fraud investigation processes.

Remote interviewing is a key investigative component for modern counter fraud teams and MeaConnexus provides a next gen solution to empower our investigators to get the best results. The product provides us with a highly secure and intuitive method by which to manage, conduct and maintain remote interviews, building on prior existing solutions with a range of innovative new features."

Head of Claims Fraud and Claims Fraud Operations Manager | Zurich Insurance, UK

RESOURCES

Insurance Resources

Stay Informed. Subscribe to Receive Our Emails.

Receive the latest news, insights and product updates straight to your inbox.

Preserve the Facts

Never worry about legal challenge or doubt again. Protect yourself from unnecessary delays and costs by proving your digital authenticity as standard.

Preserve the Facts

Never worry about legal challenge or doubt again. Protect yourself from unnecessary delays and costs by proving your digital authenticity as standard.

PRODUCTS

INDUSTRIES

RESOURCES

LEARN MORE

Approved Third Party Assurance

Provider 2025

© 2026 by Issured Ltd - Registration 08860437 | VAT 428 564 963 | MeaConnexus US Patent 11539774 | MeaConnexus Canadian Patent 3101714 | MeaFuse US Patent 12101333

LOCATION

First Floor, Unit 18

Bradbourne Drive

Milton Keynes Buckinghamshire

MK7 8BE United Kingdom

CONTACT US

LOCATION

First Floor, Unit 18

Bradbourne Drive

Milton Keynes Buckinghamshire

MK7 8BE United Kingdom

LEGAL

© 2026 by Issured Ltd - Registration number 08860437 | VAT Number 428 564 963 | MeaConnexus US Patent 11,539,774 | MeaConnexus Canadian Patent 3101714 | MeaFuse US Patent 12,101,333